Whether debits and credits increase or decrease the balance depends on the account type. The accounting equation forms the foundation of the balance sheet and is an essential principle for accurate accounting. Having a debit and a credit for each transaction ensures both sides of this equation balance. Equity is the amount that would be due to the business’s owners after any debts and liabilities are settled.Liabilities are obligations that the business has to pay another entity.Assets are resources owned by the business.

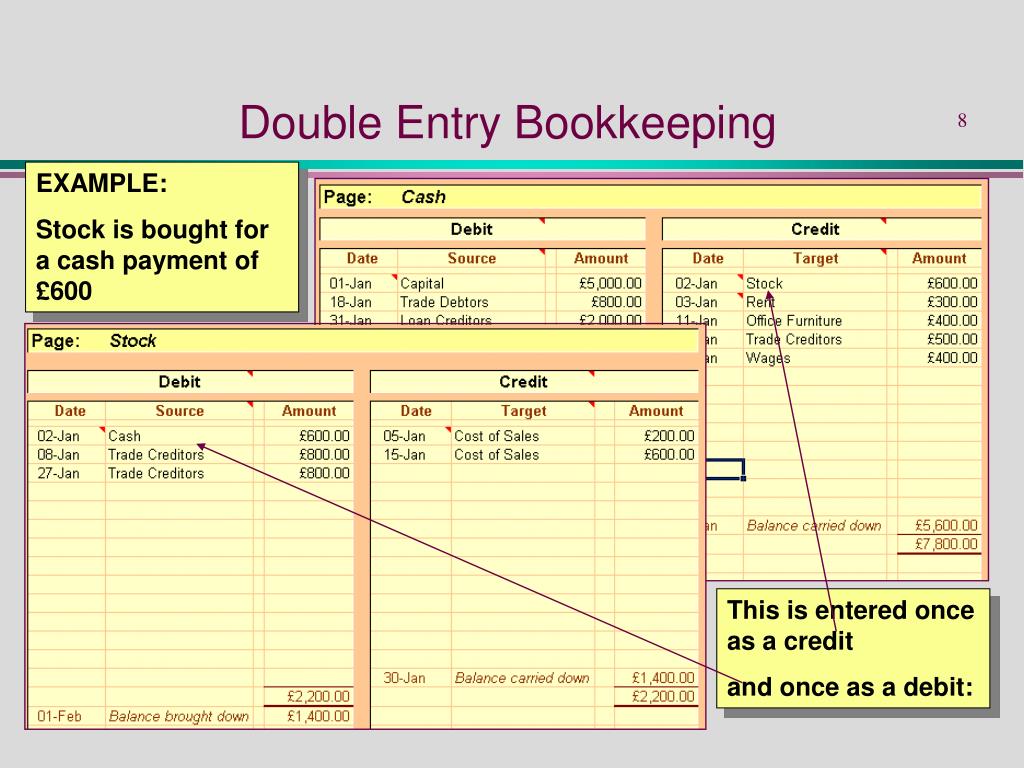

The double entry system is based on the following accounting equation: Assets = Liabilities + Equity Every transaction impacts at least two general ledger accounts: If you debit the balance of one account, you have to credit the balance of another account by the same amount. In a double-entry bookkeeping system, you record two entries for each transaction-one in a debit column (which is always on the left side of the ledger) and one in a credit column (which is always on the right side of the ledger). Learn more: 4 Reasons Startups Should Follow GAAP Accounting (and 2 Reason Why Some Delay) Accrual accounting allows you to track accounts payable, accounts receivable, and inventory-none of which are possible with single-entry cash basis accounting.Īs a result of these limitations, single-entry bookkeeping is only a viable option for very small businesses that deal with a handful of transactions.Cash accounting books revenue and expenses when cash changes hands, whereas accrual accounting recognizes revenue and expenses when the associated goods or services are delivered.Because single-entry accounting just records inflows and outflows of cash, it only supports cash basis accounting and not accrual accounting. However, it’s important to note that this method has significant limitations. Single-entry bookkeeping offers a simple way to keep track of cash payments: You can quickly set up a single-entry bookkeeping journal ledger in a simple spreadsheet or even on paper. These transactions are only verified or reconciled when the business receives a bank statement. In this example, the business receives bills from vendors for the purchases they have made and records these expenses by simply decreasing the cash balance in their books. Even if your log has separate columns for revenue and expenses, you only record each transaction once in the relevant column.īelow is an example of a single-entry bookkeeping system: The transaction amount will either be a positive value (reflecting income) or a negative value (reflecting expenses). You record the base essentials-date, description, and amount of each transaction-and keep a running total of your balance. With single-entry bookkeeping, you record each transaction once in your accounting log. Without tracking assets, liabilities, and equity, you cannot generate the proper financial statements ( P&L or income statement, balance sheet, and cash flow statement) which startup investors require. Single-entry bookkeeping systems only track revenues and expenses-they do not monitor assets, liabilities, or owners’ equity. In this article, you’ll learn what each of these approaches involves, how they compare, and which system best suits your startup’s situation. However, most founders focus on setting up a system to pay vendors and record income as soon as possible and may not be aware they need to decide between single-entry vs. Using single-entry bookkeeping when you should be using double-entry can limit the growth of your business and prevent you from carrying out essential accounting processes. Whether you’re creating a bookkeeping system from scratch or looking to improve your startup’s current approach, your choice of a single-entry or double-entry bookkeeping system (also known as single and double-entry accounting) has repercussions for how you handle every other aspect of your business finances.

0 kommentar(er)

0 kommentar(er)